Service Account Add - Screen Overview

Service Account Add

Screen Code: artsvaa

There are three methods to create a new account.

1. Create a new account from scratch.

2. Create a new account using the next available resident number.

3. Create a new account based upon an existing account.

The only difference between the three methods is that certain information is pre-filled on the screens.

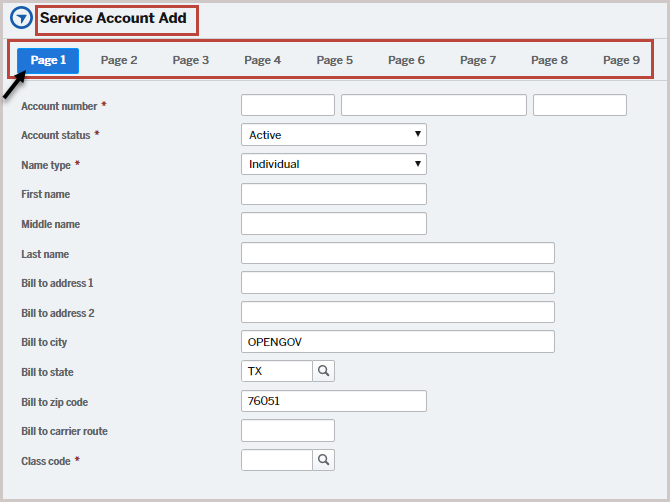

The new account screens are the same regardless of which method was selected to start the new account process. Click Add New Data + button from the Common Actions displays the Service Account Add page to add a new Service Account.

Page 1 has the following parameters:

Field

|

Description

|

Account Number

|

* Customer Account Number - 13 digit number. Refer below this table information for a detailed description of an account number.

|

Account status

|

Active - Account is active

Inactive - Account is inactive

Refund - Refund to be processed for the Account

|

Name type

|

Individual - Allows you enter First Name, Middle Name and Last Name.

Business - Allows you to enter customers' full name in a single field.

|

First name

|

First Name of the Customer

Note: (first, middle, last name only applies to "individual".

|

Middle name

|

Middle Name of the Customer

|

Last name

|

Last Name or Surname of the Customer

|

Bill to address 1

|

Billing Address Line 1

|

Bill to address 2

|

Billing Address Line 2

|

Bill to city

|

Billing City

|

Bill to state

|

Billing State

|

Bill to zip code

|

Billing Zip Code

|

Bill to carrier route

|

Part of an address to sort the mails or letters..

|

Class code

|

Customer Classification Type

(e.g. Commercial, Residential, Bankruptcy)

|

*Note: The first 3 digits of the account number is the route number. Use this to group accounts by type you desired (mowing accounts, dumpster accounts, air hangar rental, etc.). The middle part of the account number is the service address ID. Use this to keep account numbers consistent with services if desired. For example, if billing for alarm permits, a service address ID could be assigned for each house and the resident number simply incremented when a new person moves into the house.

The last 3 digits of the account number is the resident number, which makes the account a unique number. If you do not wish to keep account numbers consistent with specific services, enter the route number and you can leave the other 2 parts blank, and the system will automatically assign the next account number.

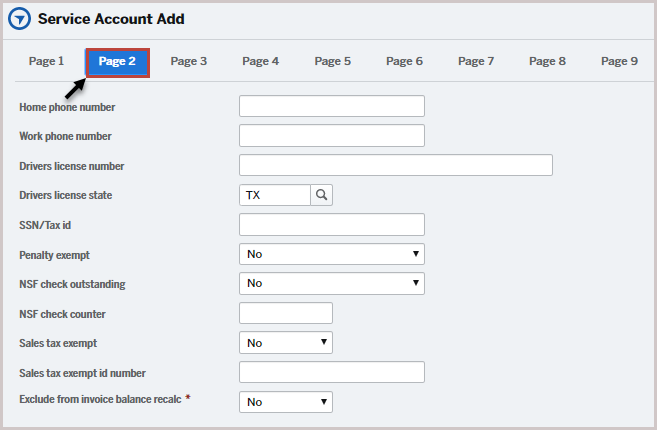

Page 2 has the following parameters:

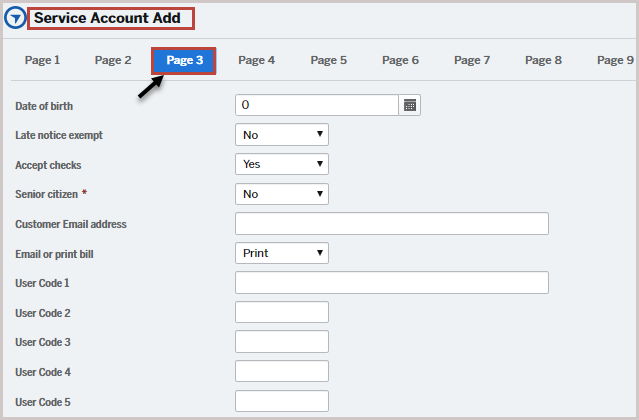

Page 3 has the following parameters:

Field

|

Description

|

Date of birth

|

Customer’s Date of Birth in mm/dd/yyyy format

|

Late notice exempt

|

No - Do not send late payment notices.

Yes - Send late payment notices.

|

Accept checks

|

Accept checks also for payment.

|

Senior citizen

|

Yes - Senior citizen (tariff concession applicable)

No - Normal tariff applicable.

Note : This field is not auto calculated based of date of birth

|

Customer Email address

|

Customer Email address. (If not provided, reset internet access password cannot be reset.)

|

Email or print bill

|

Email - Send bills by email (email address must be present)

Print - Send printed bills

Both - Send bills by Email and Printed bills also.

|

User Code 1, to 5

|

Fields from 1 to 5 can be used to add more address details if required (such as nearby location).

|

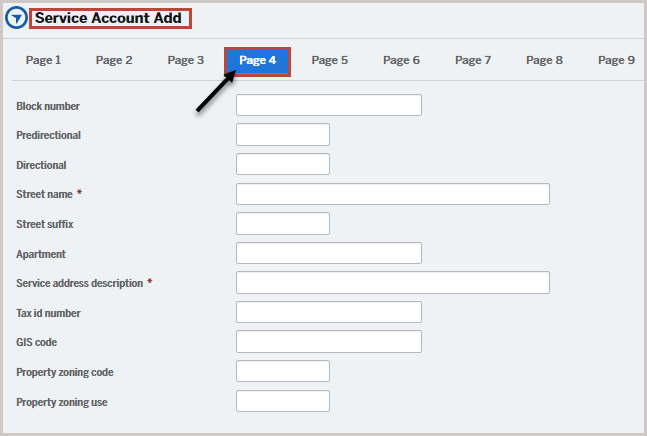

Page 4 has the following parameters:

Field

|

Description

|

Block number

|

Block number for the address.

|

Predicational

|

In postal terms, - an address element that indicates geographic location such as N, S, E, W, NE, NW, SE, and SW that is placed to the left of (before) the street name (e.g. E HOOVER ST).

|

Directional

|

Term the Postal Service uses to refer to the part of the address that gives directional information for delivery (i.e., N, S, E, W, NE, NW, SE, SW).

|

Street name

|

Street Name for the billing address

|

Street suffix

|

Street Suffix (For example, AVU for Avenue, ANX for Annex)

|

Apartment

|

Apartment Name or Number

|

Service Address Description

|

Service Address Description.

|

Tax id number

|

Tax Identification Number for the service address.

|

GIS code

Property zoning code

|

A process of assigning a location in the form of geographic coordinates (often expressed as latitude and longitude) by comparing it to other geographic data, such as street addresses, or zip codes (postal codes). With geographic coordinates the features can be mapped and entered into Geographic Information Systems, or the coordinates. In a few cases, helps to locate or track the devices installed based on locations.

|

Property zoning use

|

Refers to any municipal or local laws or regulations that dictate how real property can and cannot be used in certain geographic areas. Zoning laws can limit installing certain types of devices or instruments.

|

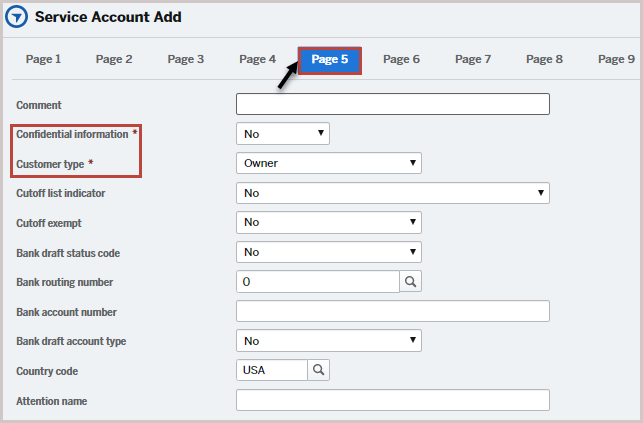

Page 5 has the following parameters:

Field

|

Description

|

Comment

|

Any comments related to address

|

Confidential information

|

For certain customers, due to confidentiality the address and other information should not be visible. For such customers set Yes.

Yes – Maintain Confidentiality of address information.

No - Do not maintain confidentiality of address information.

|

Customer type

|

Owner - Customer owns the residence or premises

Renter - Non-owner occupant or tenant of the residence or premises.

|

Cutoff list indicator

|

Yes – Show any disconnected or cutoff indicator due to late or non-payments.

No – Do not show any disconnected or cutoff indicator due to late or non-payments.

Paid since cutoff list - Show the cut off or disconnect information from last paid and resorted.

|

Cutoff exempt

|

Yes - Do not cut off or disconnect the services in case of non payments of dues.

Exempt 1 time - Exempt only first time from cut off or disconnect the services in case of non payments of dues.

No – Cut off or disconnect the services in case of non payments of dues.

|

Bank draft status code

|

Yes – Process the debit amount from the bank.

No – Do not process the debit amount from the bank.

Prenote - Payment sent and verified before direct deposit can be processed.

Draft Next Bill - Process the Draft in the next bill.

|

Bank routing number

|

A nine-digit code that's based on the U.S. Bank location where your account was opened. If you wish to use bank drafting for payments, be sure that the ACH software has been configured for Miscellaneous Accounts Receivable transactions.

|

Bank account number

|

Customers Bank account number.

|

Bank draft account type

|

Bank account type (e.g Checking, Savings, General Ledger, None)

|

Country code

|

Country code

(For example, CAN Canada, MEX Mexico, UK United Kingdom, USA United States)

|

Attention name

|

Contact person's name for the account if the customer has to be contacted. This can be different from the customer name in the account.

|

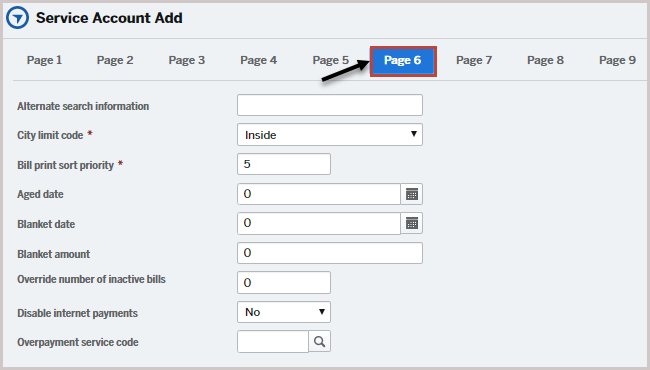

Page 6 has the following parameters:

Field

|

Description

|

Alternate search information

|

Alternate search information can be used to group accounts on the Work with Service Accounts screen (i.e. SCHOOLS, CHURCHES, etc.).

|

City limit code

|

Used for reporting and the general ledger interface.

Inside - Is the address inside the city limit

Outside - Is the address outside the city limit

|

Bill print sort priority

|

Bill print sort priority can be used to group bills together (one customer may have many accounts).

|

Aged date

|

Specify aged date to calculate the aging summary for outstanding payments.

|

Blanket date

|

Blanket amount date

|

Blanket amount

|

A single limit set for payments which applies over more than one category of payment. This is in contrast to specific or scheduled limits of payments, which are separate limits that apply to each type of payment.

|

Override number of inactive bills

|

Number of times the bill suppression can be overridden.

(e.g 5 means 5 times the inactive bills can be allowed to override)

|

Disable internet payments

|

Yes - Do not allow online payment methods.

No - Allow online payment method.

|

Over-payment service code

|

Payment in excess of what is due amount against an invoice or bill.

|

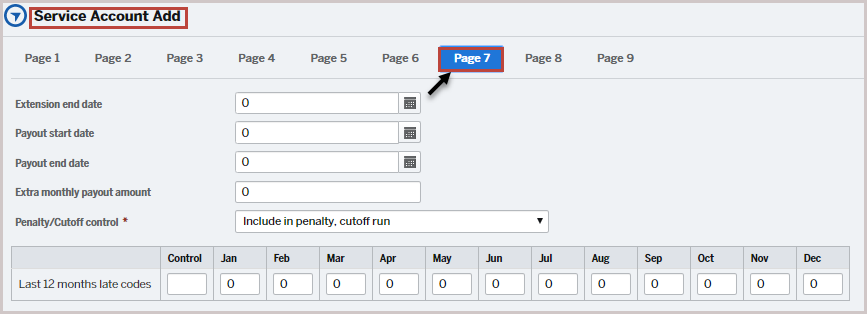

Page 7 has the following parameters:

Penalty/Cutoff control is used in conjunction with payouts and extensions to keep accounts with a payout or extension from getting a penalty. Last 12 months late codes are updated each month when penalties are assessed.

Field

|

Description

|

Extension end date

|

If the due date is missed, the date with grace period to receive the payment.

|

Payout start date

|

The date in which the payout begins.

|

Payout end date

|

The date in which the payout ends.

|

Extra monthly payout amount

|

Any extra amount to be paid if any on a monthly basis.

|

Penalty/Cutoff control

|

Provide an extension date to make the payments.

|

Control

|

Define the monthly payout pattern.

|

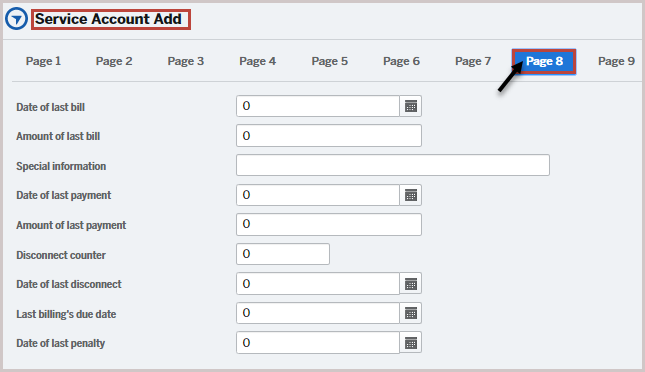

Page 8 has the following parameters:

Field

|

Description

|

Date of last bill

|

Set a last date for the bill. No bills will be generated after this date.

Indicating what the last date of the bill was. It is auto populated by the system.

|

Amount of last bill

|

Last bill amount. Auto populated by the system.

|

Special information

|

Any special instructions towards billing

|

Date of last payment

|

Last payment date. Auto populated by the system.

|

Amount of last payment

|

Last payment made by the customer. Auto populated by the system if the last payment is made by the customer.

|

Disconnect counter

|

Number of times the service was disconnected due to non payment or late payment. Auto populated by the system.

|

Date of last disconnect

|

Last time when the service was disconnected. Auto populated by the system.

|

Last billing's due date

|

Latest bill amounts due date. Auto populated by the system.

|

Date of last penalty

|

Last time penalty levied. Auto populated by the system.

|

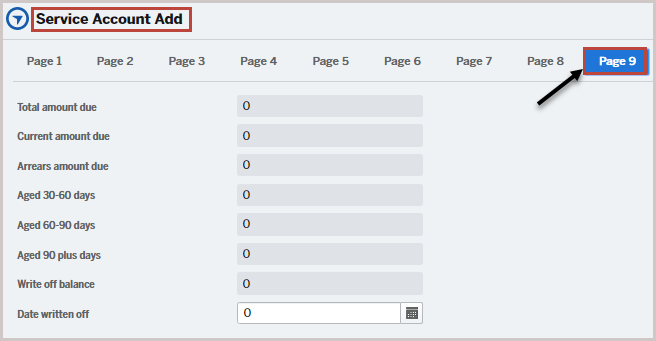

Page 9 has the following parameters:

Field

|

Description

|

Date written off

|

The date on which the amount is written off for the customer.

|

Version 1.1