Market Impact & Hedging

It’s widely understood by investors that the more patient you’re prepared to be, the cheaper on average you can trade. But in return you must run some market risk – the risk that the market might drift further if you take an hour to patiently work an order than if you push the same order through in ten minutes. Execution specialists who aim to reduce costs across a large portfolio of algo orders – accepting market risk on individual orders – will often opt to trade patiently.

Market Impact

What is it?

This is the impact on the market of sending orders to LPs.

Say you want BUY 100M EURUSD.

You buy 10M EURUSD from an LP.

The LP is short 10M EURUSD. They in turn if they want to exit their risk want to BUY 10M EURUSD. Pushing up demand for EURUSD i.e. making it more expensive to BUY.

Market Impact Measures the mid-price movement following a trade, typically measured in minutes.

We can see this in our markouts / yield profiles.

Do all products have market impact?

I don't think we will have market impact where we are tied to an ECN backed product e.g. a CFD Indices.

Or if we route hedging trades to venues where we know they are B-Booked, LPs who pass on little risk.

Why can it be bad for PnL as a market maker?

In the early days of SI we saw big market impact when we were shifting large amounts of XAU.

The cost of which didn't manifest in the hedging trades, but in the majority of risk "still to do" in the hedging pile.

The yield profiles looked good, in a way that was bad for your actual remainder risk yet to be cleared.

Is a highly positive yield profile a good thing?

A really positive hedge profile could be a symptom of noisy hedging or dealing to a high market impact LP

What should we check for when scrutinising small amounts of risk clearance?

For small amounts where there is little market impact, where we have lower levels of risk, we can look to exit trades as efficiently as possible. Arbitrage / Signal / Spread driven trading etc.

What should we check for when scrutinising large amounts of risk clearance?

We should scrutinise the performance from the point in time of the arrival of a large amount of risk. Not each trade separately.

- We should check we are not noisily clearing risk?

A really positive hedge profile could be a symptom of noisy hedging or dealing to a high market impact LP

- Are we sending orders of too large size?

If we are planning to algorithmically clear risk, do our order sizes have market impact?

- Do our cancels have market impact?

Some LPs may cancel and then front-run risk clearance of their own if they receive a large order

- Even if we make a profit, we can be masking bad hedging

Are we receiving a good spread premium (higher spreads for clients vs external venues)?

Can our clients have market impact?

Consider a client who aggregates both high and low impact liquidity together. This may be aggregating anonymous ECN liquidity, where the LPs operate faster hedging models, with bilateral LPs who aim to hold risk.

These two sources are very different in nature and often do not comingle well –likely resulting in a domino effect whereby all of the client’s liquidity deteriorates. In this example, the benefit of consuming bilateral liquidity may be lost. By grouping liquidity appropriately, clients are likely to benefit from tighter pricing and more consistent liquidity.

30 second rebate mid hedging and market impact

If you are drip feeding orders (TWAP) to mid venues with 30 second rebate. It incentivises noisy clearance from the mid venue, as it will manifest as a rebate on the 30 second reval.

By Example:

- EURUSD 100M to clear

- Clear 10M with high market impact

- The 90M risk remaining has negative reval pnl

- This loss isn't manifest in a running sum of 30 sec sum of the as yet done hedging trades.

What about market impact on our LPs?

Lower market impact allows risk-holding LPs to show tighter spreads due to the ability to warehouse the risk and hedge over a longer time horizon. Conversely, higher market impact results in LPs quoting wider spreads to cater for the faster decay of inception spread.

In the high impact scenario this creates a vicious circle, as LPs hedging behaviour will likely adjust to be faster over time as impact is observed and a feedback mechanism occurs within their hedging models. Supply and demand dictates the speed at which an LP can hedge, which varies significantly by currency and time zone.

These hedging horizons may be far longer than expected. For example, according to Butz and Oomen (2018) the average internalisation time for a tier one LP per $mn of NOK during London hours is 11 minutes. Reducing market impact allows LPs to show tighter spreads and also reduces costs of future trades for clients executing a TWAP. The below example illustrates how the client with lower market impact pays $25p/m less inception spread

Statistical significance checks

XTX have written a fantastic guide on how to know when an algo is any good, have a read here: https://www.datocms-assets.com/10954/1638269580-algo-tl-xtx-hl-nov-21.pdf

"Whenever you feel tempted to judge an algo after five runs - it happens to us all - please think of this study. Recall that this hypothetical algo with objectively strong results over the long run - it buys 50mio GBPUSD for 0.5 pips - is likely to deliver an average result after five runs of between minus 2.5 pips and plus 3 pips. There is simply too much noise or ‘luck’ in which outcome you’ll get over a handful of runs"

Bank Risk Clearance Trading Venue Type HSBC Study

The HSBC eFX desk internalizes up to 90% of risk, resulting from client transactions, benefiting clients with competitive pricing and lower post-trade market impact.

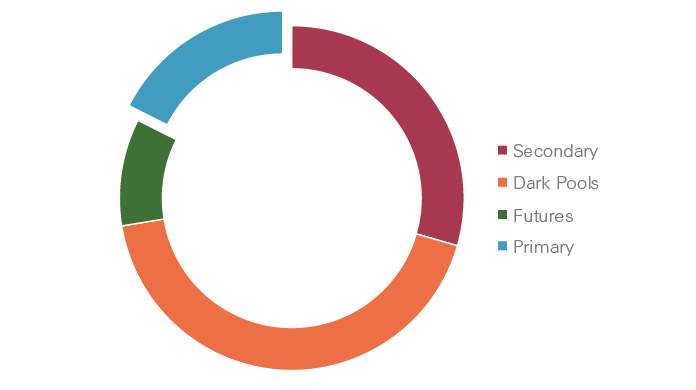

As of 2022 here is their FX risk clearance by venue type breakdown:

efx-explainers-alternative-venues.pdfefx-explainers-primary-venues.pdfefx-explainers-secondary-venues.pdf

Interesting quotes:

Given, ""For example, on average, the post 30 second market impact of trades executed by HSBC eFX desk on Primary Venues is roughly 3 times that of Dark Pools"" + HSBC pays at inception on Secondary Venues is only 1/6th compared to EBS. and "we observe that in the 30s following a EURUSD trade, EBS moves 8x more than Cboe FX". They still don't half trade with the primaries a lot.

Primary venues (EBS + MAPI) "The two venues hold ‘authority’ (depending on currency) for most global liquid FX Spot currencies due to historical precedence by interbank community / dealer acceptance of levels traded (paid / given) on these platforms"

Dark Pool Mid Venue downside: High likelihood of similar interests among participants in trending markets, leading to lower chance of matching.